epf contribution 2017

Whether you are formally or informally employed there is an option for you. Whereas the employers contribution is divided as.

Epf Interest Rate From 1952 And Epfo

Anyone can contribute to EPF to grow their retirement savings.

. This KBA 2484659 was created specially to elaborate on the above legal change on top of the SAP solution Note. Notification dated 9th April 1997 was issued enhancing Provident Fund contribution rate from 833 to 10. Break-up of the EPF contribution.

The Central Board of Trustees administers a contributory provident fund pension scheme and an insurance scheme for the workforce engaged in the organized sector in India. This page is also available in. 01042017 to 31052018 065 On total pay on.

Your contribution to EPF account is tax-deductible under Section 80C of the Income Tax Act. In case you wish to view the whole list of EPF dividend. Because I only joined the workforce and started my EPF contribution in 2000.

Epf employee contribution rate has been revised from 11 to 9 from. Know How steps in a few scenarios in accordance to the above legal change. As of now employee having monthly salary of INR.

The rate of monthly contributions specified in this part. EPF Rate 1316 W. This means your total retirement contributions for the year are.

According to epf the statutory 8 contribution rate for employees share will end as of december 2017. The rate of monthly contributions specified in this Part. Employees will no longer be granted the option of contributing 8 of their income to the employees provident fund epf.

R 1 000 x 12 R 600 x 12 R12 000 R7200. New EPF Contribution 8 YA 2017. Total tax you should pay.

Akta 800 ialah akta sistem insurans pekerjaan 2017. 12 of the employees salary goes towards the EPF. In other words the new interest rate announced will be valid from 1st April of one year to the year ending on 31st March of next year.

The EPF dividend rate for 2016 was 57. The Employees Provident Funds EPF annual contributions for 2017 rose by 638 per cent to RM6552bil against a total withdrawal of RM4940bil resulting in net inflows of RM16. Employees statutory contribution to the Employees Provident Fund EPF reverts to the original 11 for members below age 60 effective January 2018 as.

According to epf the statutory 8 contribution rate for employees share will end as of december 2017. Ministry of Labour and Employment decided to reduce PF administrative charges payable by employers. EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A 1.

Earlier the minimum salary for mandatory contribution was INR 6500 per month but this limit has been revised to INR 15000. EPF Employee Contribution Rate effective 01032016 - 31122017. You will get this tax benefit under section 80C on the extra contribution as well.

Find out how you can grow your. With this 172 categories of. Rate of contribution for employees social security act 1969 act 4.

Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. Your annual taxable income before deductions is R. The current EPF interest rate for the.

As per gazette notification issued on 15th March 2017 new rate of.

Pf Contribution Rate From Salary Explained

Epf Contribution Rate 2016 8 Or 11 Imoney

Epf 8 Vs 11 Which Is The Best Choice For You

Ss Perfect Management Epf Monthly Contribution Rate For 2021 Is Available To Download The Third Schedule Please Click At Below Link Https Www Kwsp Gov My Bi Jadual Ketiga 2020 Kwsp Pdf Facebook

Epf Admin Charges Reduced From April 2017 Updated Epf Rates Simple Tax India

Confluence Mobile Community Wiki

Do You Know Epf Offers Up To Rs 6 Lakh Of Life Insurance Edli Basunivesh

Epf Historical Returns Performance Mypf My

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Epf Contribution Rates 1952 2009 Download Table

Epf 2017 Dividend Everything That You Need To Know Ringgitplus Com

Confluence Mobile Community Wiki

Basics And Contribution Rate Of Epf Eps Edli Calculation

20 Kwsp 7 Contribution Rate Png Kwspblogs

What Is The Epf Contribution Rate Table Wisdom Jobs India

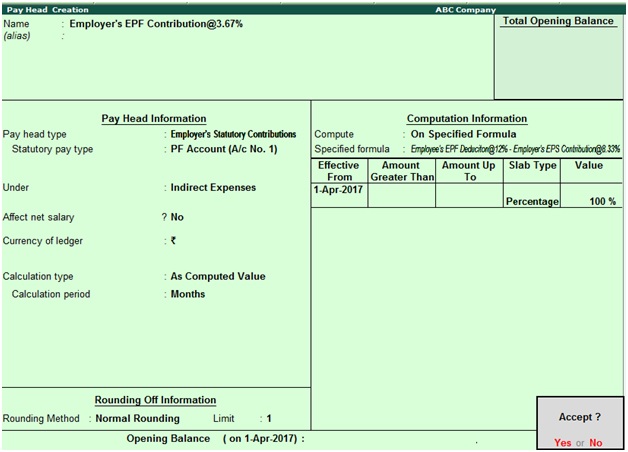

Creating Employer S Epf Contribution Pay Head Payroll In Tally Erp9 Waytosimple

No comments for "epf contribution 2017"

Post a Comment