difference between gst and sst in malaysia

Difference between GST and SST Our tax free holiday is coming to an end when SST is expected to be re-introduced effective of 1st September 2018. What is the difference between GST and SST in Malaysia.

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Keputusan Suruhanjaya Eropah EC mengenai pengiktirafan.

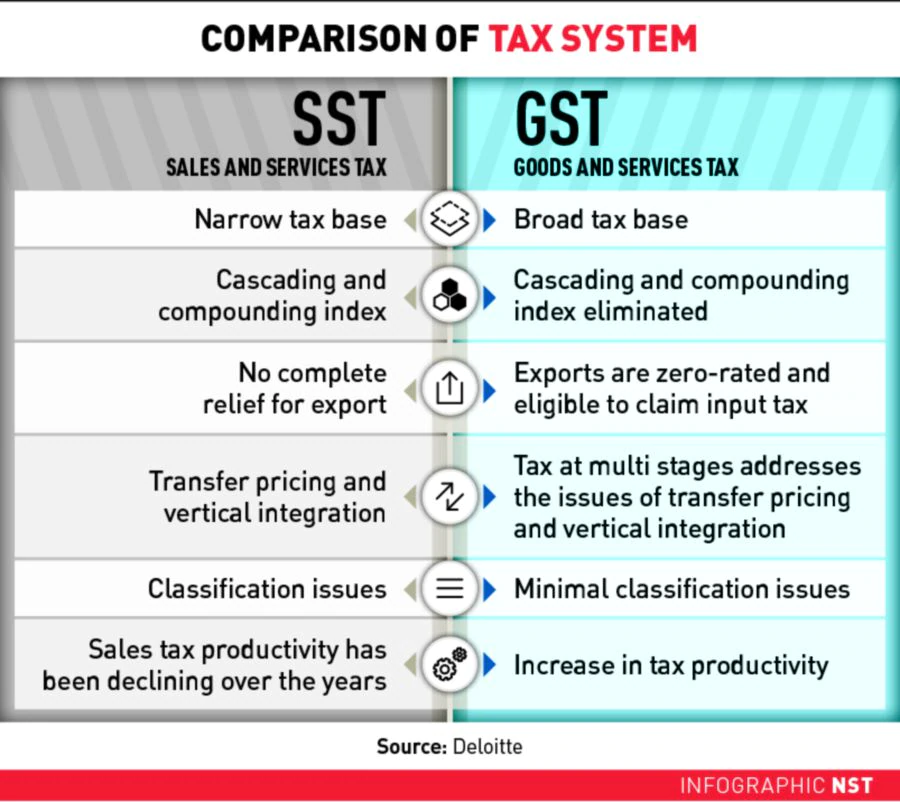

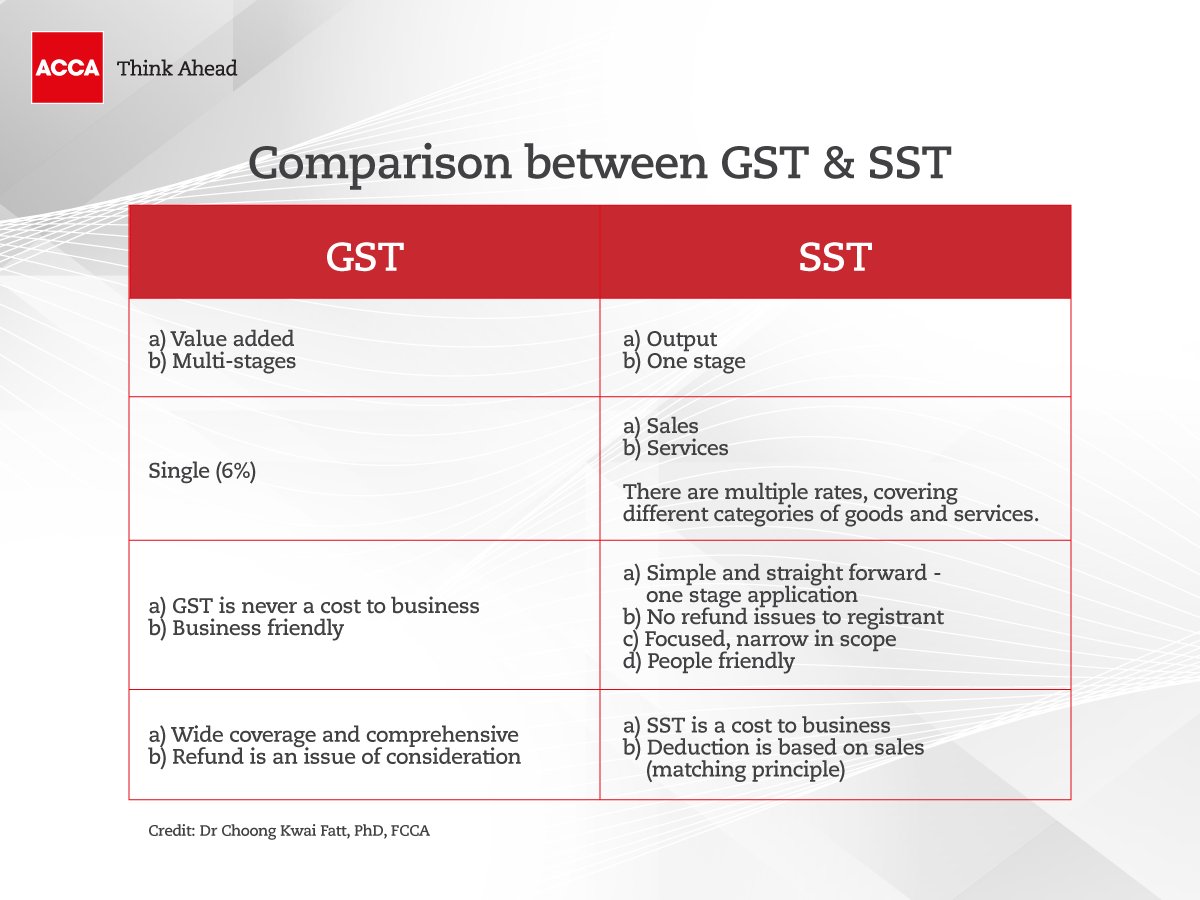

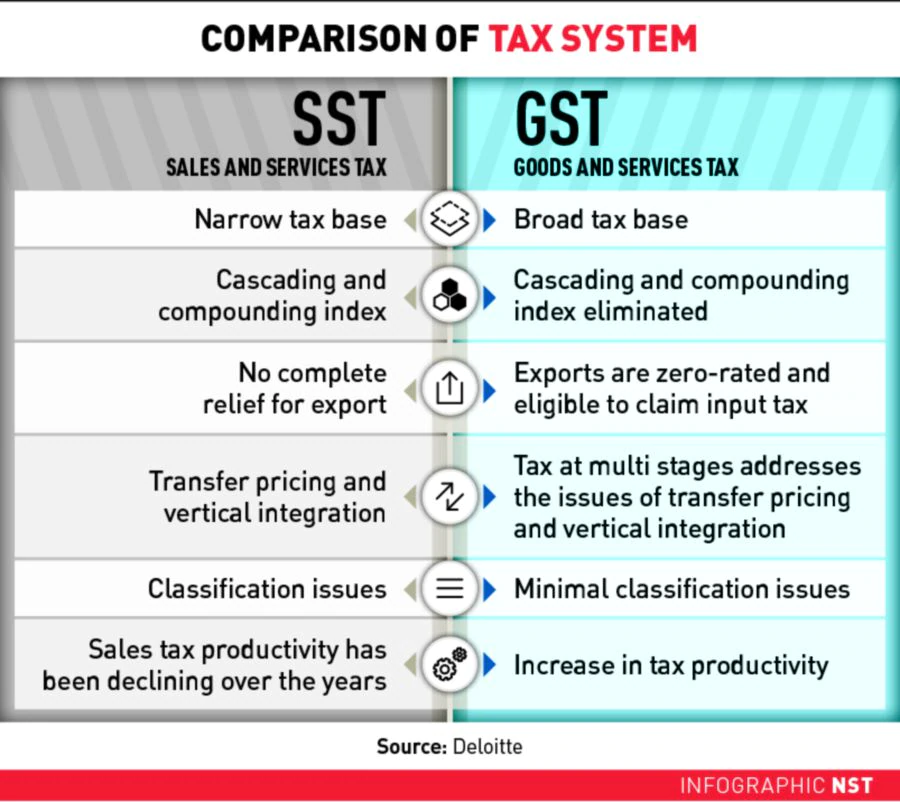

. GST is a multi-stage 6 Goods And Services tax that is charged. SST is a sales and services consumption tax paid by end customers while GST is a tax payable by all companies. The key difference is that the SST is a single-staged taxation system usually either at the consumer level or the manufacturer level while GST is multi-staged with a system of rebate for those in the intermediate stage.

Main Differences Between GST and SST. Goods and Services Tax GST Sales and Service Tax SST Multi-stage tax. GST All goods and services are subject to GST except.

People pay SST only when consuming goods while GST is a tax payable on every transaction between companies eg. Buying goods maintenance services delivery costs etc. Exempted supplies zero-rated GST relief of GST.

Here are some major differences between the GST and the SST that you should know as a business owner. GST was therefore very broad based covering the supply of all prescribed goods or services made in Malaysia and any importation of goods into Malaysia2. The difference between zero-rated and exempted goods is zero-rated are taxable supplies that are taxed at the rate of SST 0 whereas exempted goods are non-taxable and its not subject to.

A new indirect sales tax was introduced by Malaysia on 1 September 2018 to replace the previous sales and service tax SST. The SST was initially replaced by the GST. GST is business-friendly as the input tax credit is available but SST is a cost to the business.

The consumption tax replaced the 6 Goods and Services Tax GST until. There is currently a 5 and 10 sales tax rate and a 6 service tax rate. Broad-based levied on all goods and services including imports unless specifically excluded Levied on all locally manufacturedimported goods and certain prescribed services.

When Pakatan Harapan formed Malaysias Federal Government after the shocking GE 14 results they walked one of their 100 days promises which is to abolish GST Goods and Services Tax at 6 and. Sales tax however is much more narrow based being levied only on specific goods manufactured in Malaysia by a registered manufacturer3 or imported into Malaysia by any person4. SST on the other hand is considered as a service tax that is only levied on taxable services conducted by a taxable person and the sales tax is only levied either at the consumer or manufacturer level only once.

I couldnt find a copy and paste explanation on the Sales and Service Tax SST but based on reading a few explanations I conclude that the SST is a one off tax over sales and services. However the main difference lies that GST is considered an indirect and unified tax levied on both the supply and services of goods. Here are the differences between GST and SST.

What Is Service Tax And Sales Malaysia. More than 160 countries around the world have implemented GST to overcome the drawbacks of SST. Sales and Use Tax also known as SST SST The Sales Tax is solely levied at the level of the producer but the Service Tax is levied at the level of the customer who is utilizing tax services.

SST Only goodsservices that fall under the SST list are to be taxed. It is charged once at the manufacturer andor consumer level only and the tax can range between 5 10. Sales and Services Tax SST The Sales Tax is only imposed on the manufacturer level the Service Tax is imposed on consumers that are using tax services.

The key differences are as follows. Because SST is deducted based on the sales made. SST rates are less transparent than the GST which had a standard 6 rate the SST rates vary from 6 or 10.

The sales tax charged at 10 is the default sales tax rate in Malaysia. The first step of the transition began on 1 June 2018 when GST was adjusted from 6 to a 0 rate across Malaysia. The standard rate of tax.

Essentially GST is applied much more broadly than SST and involves different duties and responsibilities. Certain supplies are treated as zero-rated. In comparison to the GST which had a set rate of 6 percent the SST rates can range from 6 to.

However Malaysia has recently opted to go back to SST regime. Answer 1 of 3. This year Malaysia introduced the Special Sales Tax SST to replace the GST.

What is the difference between GST and SST. Sijil vaksinasi dan saringan COVID-19 kerajaan Malaysia kini diiktiraf Kesatuan Eropah EU untuk mempermudah pergerakan pengembara Malaysia di negara anggota itu. Krisis Ukraine-Rusia Industri automotif global dijangka terjejas.

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Comparing Sst Vs Gst What S The Difference Comparehero

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Gst Better Than Sst Say Experts

Gst Vs Sst In Malaysia Mypf My

Gst Vs Sst Which Is Better Pressreader

Gst Vs Sst A Snapshot At How We Are Going To Be Taxed

The Differences Between Sst And Gst Aesoft Technology Solutions Selangor Malaysia Newpages

Accamalaysia On Twitter As We Bid Farewell To Gst And Welcome Back Sst It Is Crucial To Understand The Differences Between These Taxes Learn About The Taxes Today And Seize This Opportunity

How Is Malaysia Sst Different From Gst

Sst Vs Gst Here Are 5 Things That You Need To Know

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

What Is Gst Goods And Services Tax Or Gst Is A Consumption Tax Based On Value Added Concept Unlike The Present Sales Tax Or Service Tax Which Is A Single Stage Tax Gst Is A Multi Stage Tax Payment Of Tax Is Made In Stages By Intermediaries In The

Gst Malaysia Info Difference Between Gst And Sst Facebook

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Gst Vs Sst In Malaysia Mypf My

How Is Malaysia Sst Different From Gst

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

No comments for "difference between gst and sst in malaysia"

Post a Comment